Related Posts

Employers and Organizations

Employee Financial Wellness: The 3 Best Delivery Methods

Last Update: May 24, 2021

Americans are stressed about finances.

A recent survey¹ found that three out of five adults feel that their finances control their lives and nearly seven out of 10 wonder if they will have enough money to retire.

This stress affects all areas of their lives. Financial stress affects their mental wellness. And it also affects employee productivity.

Salary Finance² found that financial stress costs employers about $500 billion each year, which boils down to $2,800 per employee.

These costs are due to activities such as:

- Not finishing assigned tasks

- Providing lower quality work

- Leaving for other employment²

- Missing work³

- Retiring late4

The best way to help employees relieve financial stress is to help them to achieve financial wellness.

This is not just learning about finances but learning how to leverage that knowledge in their everyday lives and when making financial decisions.

Enrich uses the following definition: Financial wellness is having the knowledge, ability, and desire to make intelligent financial decisions so that one can have the capacity to live a happy life within one’s means.

Financial Wellness Programs Are Key

The key to helping employees achieve financial wellness is to provide financial wellness benefits to employees.

A holistic financial wellness program will not only educate employees about financial concepts but teach them the skills they need to apply the concepts.

The 2020 Planning and Progress Study5 lists the following concerns among employees:

- Saving for retirement

- Saving for emergencies

- Healthcare costs

- Debt reduction

- Budgeting

- Financial goal setting

Offering a holistic, personalized, and adaptable financial wellness benefit can help employees in the areas in which they struggle.

Best Practices

Many organizations have created guides detailing best practices for implementing a financial wellness program in organizations.

These include suggestions like:

- Tie all forms of wellness – emotional, physical, and financial – together because they are all linked.

- Determine the financial needs of your workforce through such things as analyzing demographics and conducting surveys so that the program implemented meets those needs.

- Use analytics to determine how well the program is working to meet desired goals, outcomes, and behavioral changes.

- Use personalization, gamification, and incentives to engage and motivate employee participation.

- Communicate with employees about financial wellness across multiple channels.

To help organizations better understand what employees want and need in a financial wellness program, Enrich conducted a survey asking just that.

Some of the key takeaways show that employees are looking for less traditional financial wellness perks, such as flexible work arrangements and paid family leave; for programs that are personalized, trackable, and motivating; incentives increase financial wellness participation; younger employees are having financial difficulties; and employees have a preference how their financial information is delivered.

Best Methods of Delivery

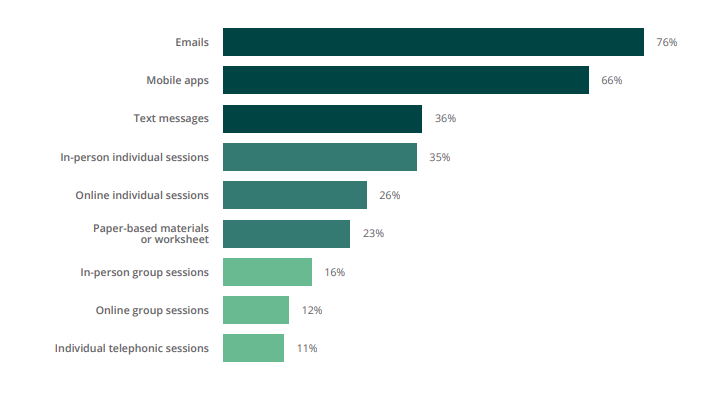

In the 2020 Employee Financial Wellness Report, respondents were asked to choose the top three ways they would prefer to receive both financial wellness content and communications about the program.

As you can see from the graph above, employees overwhelmingly favored emails, followed closely by mobile apps.

Text messages came in third but were only favored by 36 percent of employees surveyed.

This aligns with information showing that email communications continue to grow for all areas:

- 306.4 billion emails were sent and received each day in 2020

- This is projected to increase to 361.6 billion daily emails by 2024

- 4.48 billion people will use email by 2024, up over half a billion since 20186

- 99 percent of people with an email account check it at least once a day7

It is also no wonder that mobile apps are a preferred communication method since 81 percent of Americans now own a smartphone8.

Of course, when planning communication delivery methods for a financial wellness program, companies should also think about the demographics of their employees.

The same survey showed that younger employees prefer mobile apps (71 percent) to emails (61 percent) and that employees over age 55 drop mobile apps to third place, preferring emails and then in-person individual sessions.

What does this mean for employers offering a financial wellness program?

Consider the demographics of your workforce as you create a delivery system for communication and program delivery.

Offering financial wellness through a variety of channels while specifically focusing on email, mobile apps, texting, and individual in-person sessions will be the best way to encourage financial wellness participation and engagement among your employees.

For more on best practices, check out the “Financial Wellness Program Best Practices Guide”.

1 - https://www.capitalone.com/about/newsroom/mind-over-money-survey/

2 - https://www.salaryfinance.com/us/financial-wellness-guide-2019/

3 - https://www.stress.org/workplace-stress

4 - https://www.prudential.com/corporate-insights/employers-should-care-cost-delayed-retirements

5 - https://news.northwesternmutual.com/planning-and-progress-2020

6 - https://www.statista.com/statistics/456500/daily-number-of-e-mails-worldwide/

7 - https://dma.org.uk/research/dma-insight-consumer-email-tracker-2017

8 - https://www.pewresearch.org/internet/fact-sheet/mobile/

Featured Posts

Employers and Organizations

3 MIN

10 Simple Ways Benefits Managers Can Recession-Proof Their Employee Benefits Package

Employers and Organizations

3 MIN

3 Reasons to Make After-Tax Contributions to Your Retirement Plan

Employers and Organizations

4 MIN

Financial Information vs Employee Behavior Change: Which Is More Important for Your Company’s Financial Wellness Program?

Employers and Organizations

3 MIN

Does Your Employee Financial Wellness Program Take Mindset Into Consideration?

Related Posts

Employers and Organizations

3 MIN

Is Financial Wellness a Must-Have Employee Benefit?

Enrich News

2 MIN

How Financial Wellness Affects Employee Health

Employers and Organizations

3 MIN

How Financial Wellness Programs Reduce Employee Financial Stress