Related Posts

Employers and Organizations

The Secret to Conquering Employee Financial Stress

Last Update: April 20, 2020

In good times and in bad, there is a constant for employees – financial stress.

Surveys consistently show that employees, both those with low incomes and those who are high earners, experience financial stress.

In a recent report1, Morgan Stanley found the following:

- Each month, half of employees spend more than they earn

- Over a third of employees feel their debt is unmanageable

- 2 out of 5 do not have enough emergency savings to live for three months

- More than half of employees making more than $100,000 still feel financial stress

Unfortunately, such stress has a big impact on the companies that employ these workers.

How Financial Stress Affects Employers

Employees dealing with financial stress often bring that stress into the work environment. This has a direct impact on the bottom line of their employers.

The Morgan and Stanley study found that 78 percent of employees who are dealing with financial stress are distracted at work.

PwC’s 8th Annual Employee Financial Wellness Survey 2019 found that 49 percent of financially stressed employees spent three or more hours each week dealing with financial issues while at work.2

On average, distraction costs a company up to 10 times more than absenteeism.3

In addition to distraction, which is sometimes called presenteeism, financially stressed employees are also more likely to look for other employment, have more accidents, take more sick days, save less for emergencies and work beyond retirement.

All of this leads to greater expenses for the employer.

Lack of Emergency Savings Affects Employees

Overall, the biggest sources of financial stress for employees of all income levels include debt, emergency expenses and lack of adequate savings.

Emergency savings are important for the overall financial wellness of an employee because it provides a cushion if something unexpected comes up.

Even if an employee still has financial issues, having a savings account that can see them through difficult times provides a strong level of comfort. Plus, having the savings account will help prevent the stress of the remaining two significant sources of financial stress.

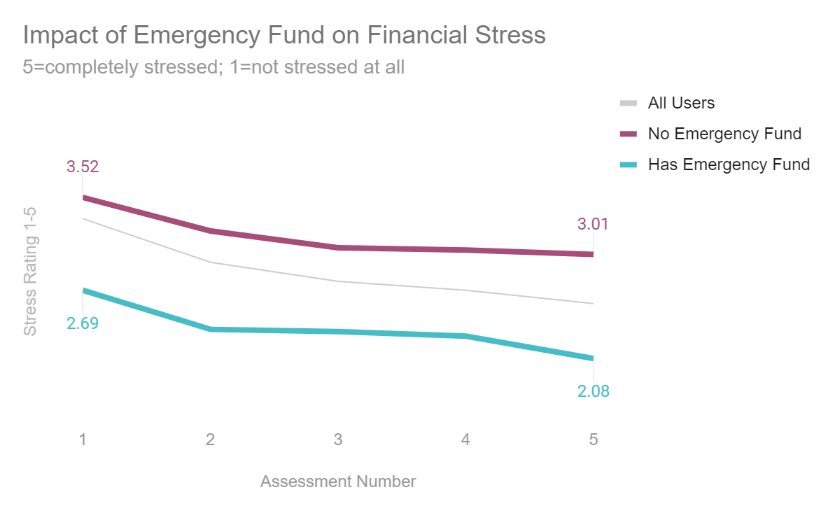

At Enrich, data shows the impact that having an appropriate level of emergency savings, defined as at least three months of living expenses, has on one’s financial stress.

[Employee financial stress goes down over time when using the Enrich Financial Wellness program, with those that have at least a 3-month emergency savings fund exhibiting the lowest stress levels.]

As you can see, those most stressed are those without an emergency fund.

Simply having an emergency fund, even if the employee’s financial assessment number is low, has a significant bearing on the amount of stress they feel.

Financial Wellness Can Help

There are several reasons why a good financial wellness program will lower financial stress. But not all financial wellness programs have the necessary components to do this.

In 2019, Enrich users saw an average decrease of 23% in their financial stress levels.

When asked what can be done to help them with their financial stress, employees suggested getting help with such topics as:

- Budgeting

- Managing debt

- Creating an emergency savings account

- Saving for retirement

- Understanding investing

- Choosing appropriate insurance options

However, two-thirds of employees state that their employers do not offer a financial wellness benefit that provides the help they need.

A "holistic" financial wellness program offers personalized tools to provide employees with needed education and steps to take to decrease financial stress.

Because employees want these benefits, they use them to:

- Prepare for retirement - 47 percent2

- Get spending under control – 29 percent2

- Pay off debt – 29 percent2

- Save for major goals – 29 percent2

- Manage investments – 29 percent2

- Manage healthcare expenses – 18 percent2

Additionally, by reducing employee stress, a financial wellness program increases productivity and retention.

In fact, almost two-thirds of employees state they would be more likely to stay with an employer that offered such benefits.1

Three Things Employers Can Do to Facilitate Emergency Savings

Since the addition of emergency savings reduces stress, you’ll want to be sure that your financial wellness program helps employees create a “rainy day” fund.

To do this effectively, the program should focus on two key strategies: Automation and creating a dedicated/separate savings account.

Here are three ways to help your employees save money for an emergency:

Budgeting Exercises

The goal is to show employees where they can cut back on expenses to increase savings.

Financial wellness programs with personalized budgeting tools can help employees track their current spending and “find” money.

For instance, creating a budget can reduce the amount spent on eating out or encourage an employee to explore cheaper cell phone or cable options.

This money can then be used to create an emergency savings account.

Conduct Training

Some employees don’t save money because it isn’t automated or the automation seems too difficult to understand.

By conducting training, you can show employees how to do a direct deposit split to automatically put a portion of every paycheck away into a separate savings account.

Savings Matching on Sidecar Savings Accounts

A sidecar savings account is linked to an employee’s retirement account and payroll. Employees will be able to contribute to both funds at the same time automatically.

Once the emergency funds are at a prescribed level, all contributions automatically go toward retirement funding.

Then, as an employer, you can match a percentage of their direct deposits. This is similar to matching for retirement savings.

More and more companies are learning that reducing employee financial stress has many positives, all of which impact the bottom line.

1 - https://s3.amazonaws.com/cfsi-innovation-files-2018/wp-content/uploads/2019/05/24163214/FHN-MorganStanley-Infographic-FINAL.pdf

2 - https://www.pwc.com/us/en/industries/private-company-services/library/financial-well-being-retirement-survey.html

3 - https://www.ehstoday.com/safety-leadership/article/21918281/presenteeism-costs-business-10-times-more-than-absenteeism

Featured Posts

Employers and Organizations

3 MIN

10 Simple Ways Benefits Managers Can Recession-Proof Their Employee Benefits Package

Employers and Organizations

3 MIN

3 Reasons to Make After-Tax Contributions to Your Retirement Plan

Employers and Organizations

4 MIN

Financial Information vs Employee Behavior Change: Which Is More Important for Your Company’s Financial Wellness Program?

Employers and Organizations

3 MIN

Does Your Employee Financial Wellness Program Take Mindset Into Consideration?

Related Posts

Employers and Organizations

5 MIN

5 Ways Your Financial Wellness Program Relieves Employee Financial Stress

Employers and Organizations

3 MIN

How Financial Wellness Programs Reduce Employee Financial Stress

Enrich News

2 MIN

How Financial Wellness Affects Employee Health