It starts with a consultation

We help our partners identify their key objectives for implementing a financial wellness program. We can focus on benefits/ services adoption, DEI, stress reduction, productivity, data collection and insights - and then we configure our portal and reporting to your specific needs.

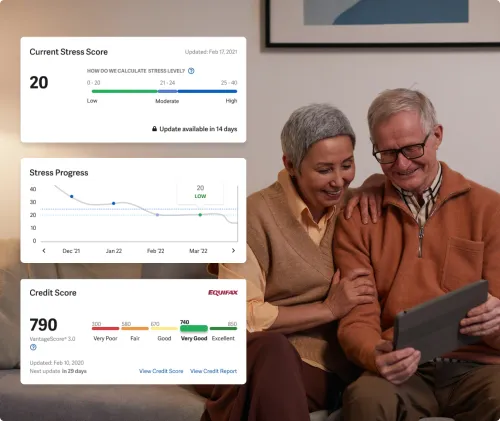

Personalized solutions

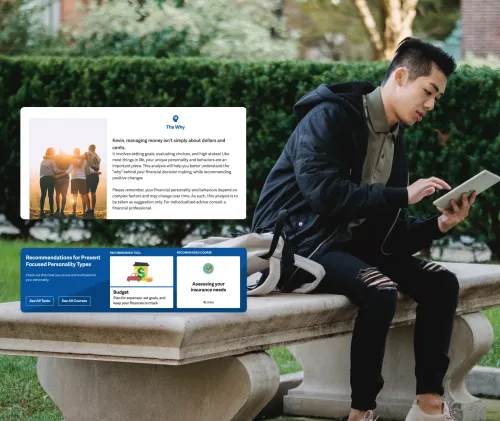

With over 100 configurations available on our platform, you’re guaranteed a program that meets your employees’ or customers’ needs. We then generate engagement using a financial personality assessment and gamification.

Get immediate adoption

By combining psychology, gamification, and program customization we generate wider adoption and ongoing engagement.

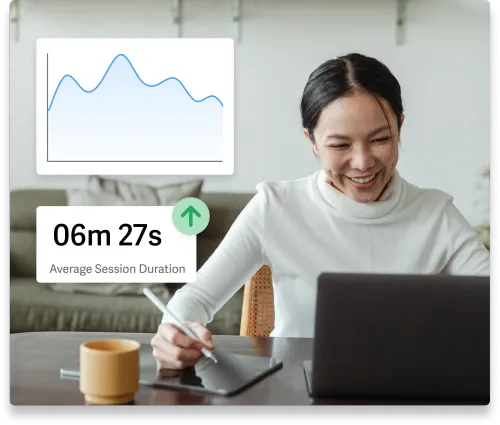

Measure the results

Our real-time reporting console and monthly PDF summaries keep the data you need at your fingertips. Monthly, bi-annual and annual summaries are configured so that you can present the results of the program as needed, helping you to validate the program and determine ROI.

Our Partners

Trusted by over 12,500 organizations including employers, financial institutions, and government agencies.

Ready to learn more?

See How Our Program Works

Who We Help

Case Study: ”How Enrich Has Influenced Positive Financial Behavior Changes in Users”

Case Study: ”How Enrich Has Influenced Positive Financial Behavior Changes in Users”

Smart Employers Trust Financial Wellness -- Here’s Why

Your employees, partners, and members worry about money-regardless of how much they earn. Studies show financial stress is everywhere and results in a lost hour every work day. This stress makes life difficult for your employees, partners, or members. It increases use of sick days and absenteeism. The solution? Financial wellness programs.

The science of why financial wellness programs work is simple. Providing solutions tailored to your members, partners, or employees’ needs alleviates the learning labor burden (which increases adoption and use). Your users realize results right away. This lowers stress. Lower stress creates better at work focus, higher productivity, and overall happier employees.

Discover personalized financial wellness to make your employees, members, or customers happier, healthier, and more financially secure by clicking the link below.

Ready to Enrich the lives of the people you work with?

Let’s Talk Financial Wellness