Student Loan Repayment Program

Provide student loan support to attract new talent and increase employee retention.

How Your Student Loan Program Will Work

Customized program for each client

Our team reviews your needs. We identify the best path forward then tailor a contribution plan to meet your employee’s needs. You’ll have complete control from picking who is eligible, the type of plan you’ll provide, the contribution amount, and frequency of contribution.

Full-Service Onboarding

Our team handles everything. That includes onboarding, educating new employees with our personalized course, explaining contribution benefits, supporting them through enrollment, syncing their loans, and picking which loans to start with. We do the hard work so your employees can focus on working hard for you.

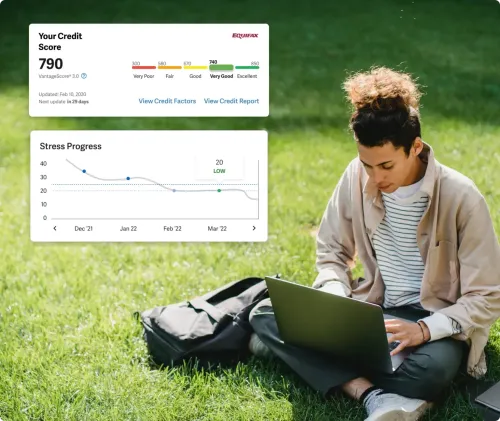

Ongoing Financial Education

Financial education is crucial. That's why we ensure your employees have access to our comprehensive and holistic financial well-being platform. Employees will learn systems to master budgeting, credit, managing debt, and how to set up retirement. The platform presents topics in a variety of formats so users can engage in the resources and tools best suited to how they learn.

Additional Support Provided

Our team connects your employees with the best solution for their needs. If an employee needs help with Student Loan Refinancing, we provide education and support. We will work with your employee to identify the best solution for their needs along with all their refinancing options.

We also support employees setting up a 529 contribution plan. Our team will research and provide feedback to assist your employees in picking and implementing the best benefit for their goals.

Our Partners

Trusted by over 12,500 companies to empower their users with personalized financial education.

Awards & Recognition

Pensions & Investments

Eddy Award: Financial Wellness

Pensions & Investments’ annual Eddy Awards recognizes plan sponsors and service provider leaders who offer investment and financial education to their participants regarding smart strategies to invest and plan for retirement.

Institute for Financial Literacy

Education Program of the Year

Established in 2007, the mission of the Excellence In Financial Literacy Education (EIFLE) Awards is to promote the effective delivery of consumer financial products, services and education by acknowledging the accomplishments of those that advance financial literacy education.

AFCPE Award

Outstanding Consumer Info

The annual award is given to a company or agency that displays scope, timeliness and scholarship in its approach to financial literacy, and provides information useful to those working in the field of financial counseling and planning.

Frequently Asked Questions

Will this help my employees pay off their loans faster?

Why do they need help? Can’t they just make payments?

What type of data do you need on an ongoing basis and how frequently?

What data files are required from the employer for implementation?

Have another question? Talk with our team

Contact Us