Related Posts

Employers and Organizations

3 Reasons Why Supporting Employee Financial Wellness Makes Sense (Based on PwC survey)

Last Update: June 19, 2023

In a majority of cases, employee financial stress is getting worse. The pandemic brought about layoffs, salary reductions, and bonus freezes. The current inflation rate has reduced spending power and increased prices for everyday necessities like food, housing, and fuel.

A recent PwC survey1 on employee financial wellness found that:

- 25% of employees experienced a decrease in overall household income

- 53% could not meet basic expenses if they lost their income

- 49% believe they will need to delve into their retirement accounts early

- 42% have trouble meeting monthly expenses

They also found that employees are carrying more credit card debt, have more financial insecurity, and are more likely to have filed for bankruptcy protection.

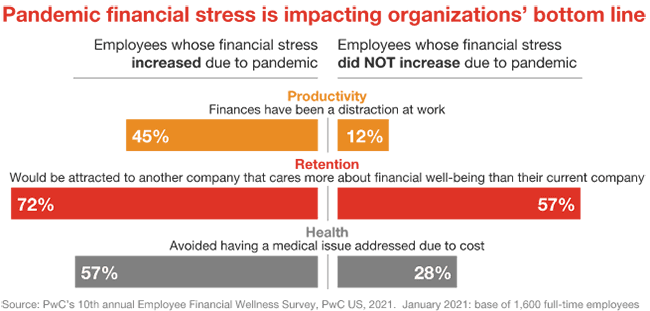

When employees struggle with personal finances, they bring that struggle with them to work, affecting the bottom line of their employers. The three main areas affected by employee financial stress include productivity, retention, and physical health.

Productivity

The survey found that employees with financial stress are four times as likely to state that their finances have been a distraction at work. A Prosperity Now study2 found the situation to be even worse with nearly all employees (97%) working on or thinking about their finances while at work. Other studies have found:

- 34% increase in absenteeism and tardiness3

- Financially stressed employees miss twice as many days each year4

- Half of those distracted by their personal finances spend 3+ hours each week at work dealing with their finances5

Unfortunately, these distractions cost businesses up to $300 billion a year in lost productivity6.

Retention

The PwC survey found that all employees were more likely to be attracted to a company that cares about their finances. However, those with financial stress were far more likely to consider switching employers.

A recent survey by Betterment 401(k)7 found that employees expect to get financial help from their employers. Four out of five employees believe that this kind of help is a sign that an employer values them. Amazingly, seven out of ten would prefer this kind of help over an extra week of vacation.

If they don’t feel valued, they are willing to find employment elsewhere. This voluntary turnover costs companies from one-half to two times an employee’s annual salary8. For US companies, that is $1 billion annually.

Physical Health

Financial stress also causes significant health problems in employees including such issues as heart disease, obesity, migraines, and depression. However, employees with financial stress are also far more likely to put off getting the medical attention they need, only exacerbating the problem.

Estimates suggest that between 75% and 90% of all doctor visits are due to issues caused by stress9. And with so many employees feeling financial stress and avoiding the doctor until the problems are overwhelming, the healthcare costs are enormous, putting a strain on the healthcare system and increasing healthcare costs for employers.

The link between financial stress and an employer’s bottom line is significant. Thankfully, there is a simple way to help – provide employee financial wellness benefits.

The Enrich program provides employees with personalized benefits to meet their unique needs.

Whether they need help learning how to budget, pay off student loan debt, buy their first home, reduce credit card debt, save for retirement, or anything in between, Enrich can help them address their financial situations.

To learn more about how Enrich can help you add a financial wellness program to your compensation package and reap long-term benefits by improving employee financial health, request a demo.

1 - https://www.pwc.com/us/en/services/consulting/workforce-of-the-future/library/employee-financial-wellness-survey.html

2 - https://prosperitynow.org/files/PDFs/workplace_financial_wellness_services.pdf

3 - https://www.ifebp.org/bookstore/financial-education-2016-survey-results/Pages/financial-education-for-todays-workplace-2016-survey-results.aspx

4 - https://squaredawayblog.bc.edu/squared-away/work-absenteeism-tied-to-money-stress/

5 - https://www.pwc.com/us/en/industries/private-company-services/images/pwc-8th-annual-employee-financial-wellness-survey-2019-results.pdf

6 - https://www.healthadvocate.com/downloads/webinars/stress-workplace.pdf

7 - https://resources.betterment.com/hubfs/PDFs/b4b/reports/financial-wellness-benefits-survey.pdf

8 - https://www.gallup.com/workplace/247391/fixable-problem-costs-businesses-trillion.aspx

9 - https://www.webmd.com/balance/stress-management/effects-of-stress-on-your-body

Featured Posts

Employers and Organizations

3 MIN

10 Simple Ways Benefits Managers Can Recession-Proof Their Employee Benefits Package

Employers and Organizations

3 MIN

3 Reasons to Make After-Tax Contributions to Your Retirement Plan

Employers and Organizations

4 MIN

Financial Information vs Employee Behavior Change: Which Is More Important for Your Company’s Financial Wellness Program?

Employers and Organizations

3 MIN

Does Your Employee Financial Wellness Program Take Mindset Into Consideration?

Related Posts

Employers and Organizations

6 MIN

How to Calculate Financial Wellness ROI

Employers and Organizations

3 MIN

Quantifying the ROI of a Financial Wellness Program: Questions to Ask

Employers and Organizations

5 MIN

Which Employee Benefits Have the Highest ROI?