Related Posts

Financial Institutions

Building a Financially Resilient Community: The Role of Credit Unions

Last Update: March 25, 2024

Having the ability to bounce back from financial shock and misfortune can make a huge difference. Financial resilience is crucial for any person or organization – and it’s a skill that credit unions can help to foster within their communities.

According to research, four factors affect this ability:1

- The money and resources people have

- Their level of financial education

- How many financial services they can access

- Other socio-demographics

As a non-profit organization, a credit union can play a role in helping members improve on such factors. If they can improve financial wellness on the community level, they can also do it for the economy.

Credit unions can make changes through impactful initiatives and efforts, which is what we're aiming to shed light on in this article.

The Broader Community Impact of Financial Wellness Initiatives

Wherever possible, credit unions should be aware of the ripple effect their initiatives can have. Let's say we have a couple who are both members.

The couple will benefit from joining a financial education workshop offered by the credit union. There, they can learn more about savings, budgeting, and debt.

Later on, they also learn how to manage financial stress and start saving for an emergency fund or retirement. Then, they’ll be a success story for other community members, inspiring others to join the union and start a cycle of financial empowerment.

And it all starts with member engagement. Here are a few initiatives a credit union can take part in:

- Offer financial education programs

- Promote resources for financial coaching

- Personalize their efforts and plans based on the unique needs of their members

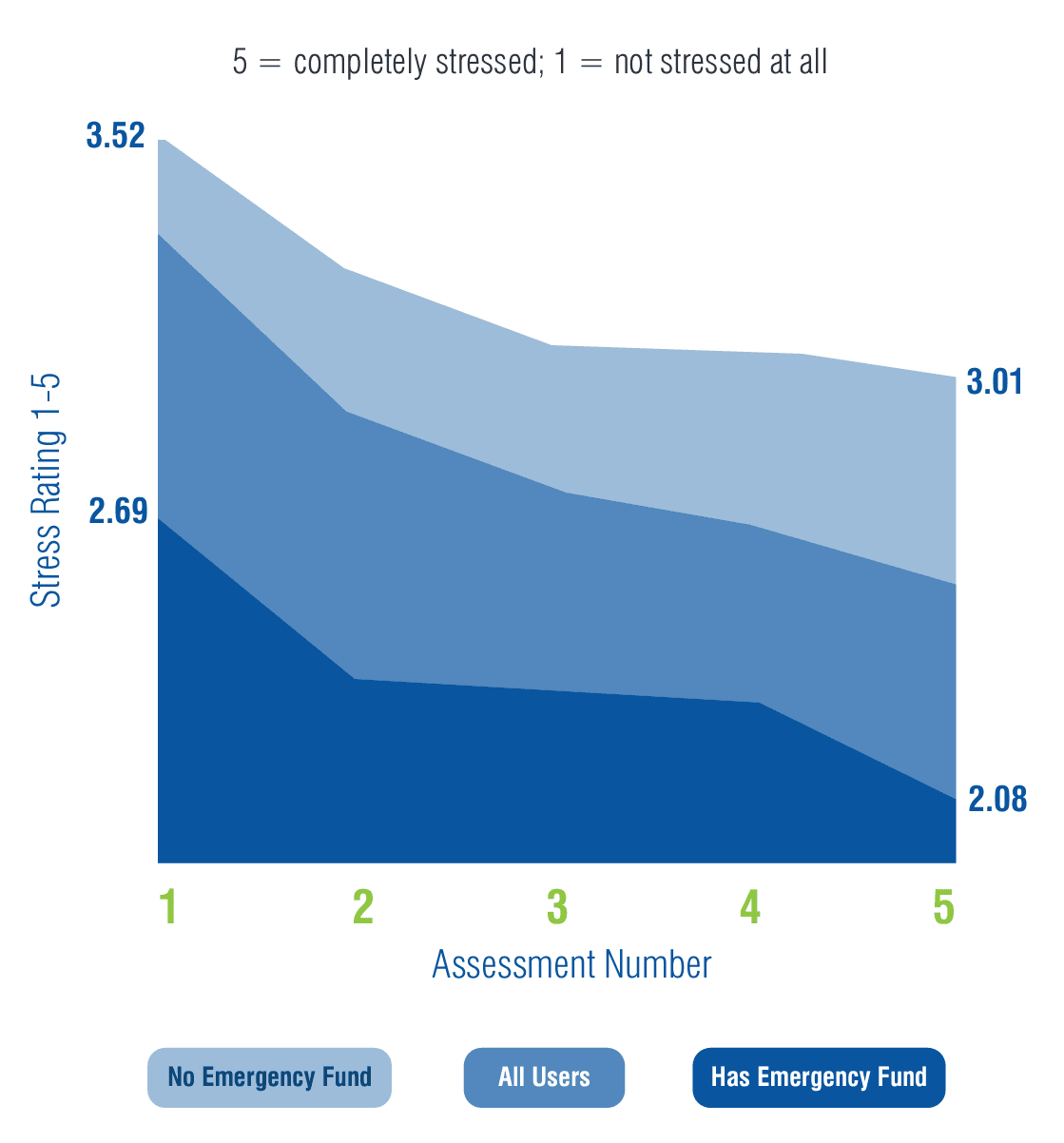

See the photo below for a real-life example of how a financial wellness program can benefit people:

This is one of the findings of Enrich's 12-month study. We also saw great improvements in retirement plan contributions, savings, credit card payments, and goal achievements.

Note that credit unions aren't alone in this work. Many of them collaborate with local organizations and other stakeholders.

Doing so contributes to holistic financial wellness because members spend most of their time with these outside entities.

In cooperation with municipalities, community organizations, companies, and schools, credit unions can achieve even more. This lets them pave the way for high member acquisition rates.

The Role of Credit Unions in Fostering Financial Resilience

Credit unions set themselves apart from the rest of the financial world. These non-profit organizations, geared toward their member communities, embody a unique mission. Their goal? To foster member financial wellness and build financially resilient communities.

Embracing Member-Centricity

Member engagement and member acquisition underscores everything credit unions do. Some of the ways credit unions can maintain a member-centric approach is by offering benefits like:

- Financial education programs

- Savings and loan products

- Special programs for different demographic groups

- Digital services

An Emphasis on Mental Well-being and Economic Strength

Having power over their money doesn't only mean monetary wealth for members. It also has an impact on their overall well-being.

Credit unions focusing on education and empowerment can see its benefits when it comes to members' mental health. With a more balanced lifestyle, their members can work to get rid of financial stress, one common source of other mental health issues. Meanwhile, there's also a benefit to the community's economic vitality.

For example, a credit union can extend micro-loan opportunities for small businesses. By doing so, they're supporting the creation of more jobs within the community.

Leadership in Action

Credit unions are at the forefront of financial support, and there are a few good examples other unions can look at:

- BECU in Washington State developed the "Closing for Good" program. For a day, all employees educate high school students about personal finance. This bridges the gap in financial literacy for the young.

- North Carolina’s State Employees' Credit Union has a scholarship program. This consists of three tiers, mainly for high school, college, and postgraduate studies.

- Suncoast Credit Union has student-run branches. These are credit union branches run by students. With it, the union fosters an understanding of personal finances from a young age.

Leveraging Technology and Innovation for Greater Impact

Here's the thing about today's fast-paced life: it's largely digital. More than ever, credit unions must engage with this sphere. This isn't merely about swimming with the tide. Embracing digital platforms is about reaching out to members where they are and when they need it.

With a simple tap here and a click there, members can access financial resources right away. Do they need a fast check on their accounts? No problem. Want to monitor spending or apply for a loan? Easy.

Online workshops can also get members up to speed on a range of topics. These include the nuts and bolts of budgeting, guides to understanding credit scores, or easy ways to handle debt.

But that's not enough. Credit unions must also adapt to the ever-changing financial landscape.

Understanding the dynamic needs of members requires innovative solutions. Unions can look into offering the following ancillary tools:

- Stress analysis tools that help unions make more tailored solutions for financial coaching

- Financial calculators for savings, loan interest, and budgets

- Money mindfulness resources that help members have a positive and active watch over their money

Final Thoughts

Credit unions play a vital role in promoting financial wellness. In doing so, they're helping to create financially resilient communities.

If you’re coordinating or promoting a financial wellness initiative for your credit union, you don’t need to navigate the process alone. Consider a financial wellness platform like Enrich, which can streamline the entire process for you.

Want to know how? Watch this demo video and take a step toward enhancing your members' financial wellness journey.

Featured Posts

Employers and Organizations

3 MIN

10 Simple Ways Benefits Managers Can Recession-Proof Their Employee Benefits Package

Employers and Organizations

3 MIN

3 Reasons to Make After-Tax Contributions to Your Retirement Plan

Employers and Organizations

4 MIN

Financial Information vs Employee Behavior Change: Which Is More Important for Your Company’s Financial Wellness Program?

Employers and Organizations

3 MIN

Does Your Employee Financial Wellness Program Take Mindset Into Consideration?

Related Posts

Financial Institutions

The Role of Credit Unions in Empowering Financial Wellness and Education

Financial Institutions

The Benefits of Credit Union Financial Education Programs

Financial Institutions

Why Credit Unions Need to Focus On Member Education Initiatives