Related Posts

Financial Institutions

What is Financial Wellness?

Last Update: April 12, 2021

What is Financial Wellness?

And why is it growing in popularity?

Jump directly to a section on this page:

- What is Financial Wellness?

- Why Does Financial Wellness Matter?

- Who Needs Financial Wellness?

- Where To Get a Financial Wellness Program

- How and When Is Financial Wellness Delivered to Employees?

- What to Expect from a Financial Wellness Program?

- Financial Wellness Engagement and Utilization

- Financial Wellness ROI

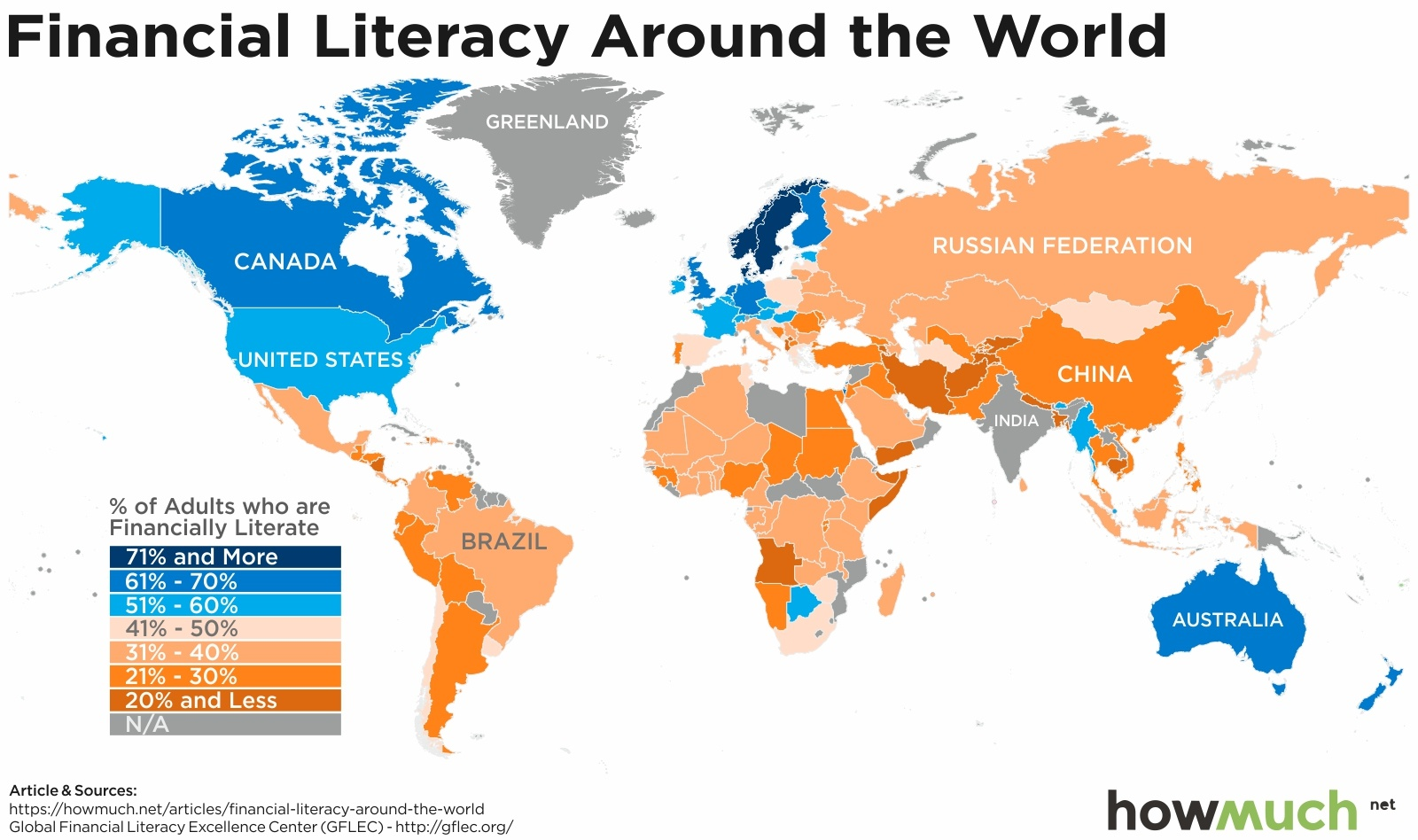

There is a lot of talk about financial literacy and how a significant portion of Americans cannot pass even the most basic of financial literacy tests.

The Standard & Poor's Ratings Services Global Financial Literacy Survey¹ found that only 57 percent of U.S. adults are financially literate.

Because of such findings, there is a push to help people understand financial terms such as compounding interest, inflation and risk diversification.

Unfortunately, although financial literacy is a needed component, it is not the definition of financial wellness.

If 57 percent of adults are financially literate, it would stand to reason that a similar percentage of adults should be financially well, but that is not the case.

Even before the COVID pandemic, a majority of Americans had financial concerns.

The Capital One Mind Over Money Survey² found that:

- 58 percent feel that finances control their lives

- 68 percent wonder if they will have enough to retire

- 56 percent are concerned if their earnings will keep up with the cost of living

- 45 percent worry about managing debt

To make matters worse, those experiencing financial stress are less likely to engage in healthy financial habits such as creating a budget, saving and making financial goals.

So, if financial wellness is not simply financial literacy, what is it?

The 8th Annual PWC Employee Financial Wellness Survey³ asked employees for their definition of financial wellness.

What is Financial Wellness?

Financial wellness means to be stress-free and achieve financial stability, which includes being debt-free, having savings, meeting day-to-day expenses, retiring on time and having the freedom to make life choices.

At Enrich, we expand upon this definition: Financial wellness is having the knowledge, ability, and desire to make intelligent financial decisions so that one can have the capacity to live a happy life within one’s means.

The term "Financial Wellness" is also used to describe interactive digital platforms that educate, motivate, and empower individuals to reach this goal.

Why Does Financial Wellness Matter?

Instead of focusing completely on financial literacy, we believe that a holistic approach that focuses on literacy, skills and behavior changes will make the biggest difference in your employee’s lives.

For instance, financial wellness can address problems like the following:

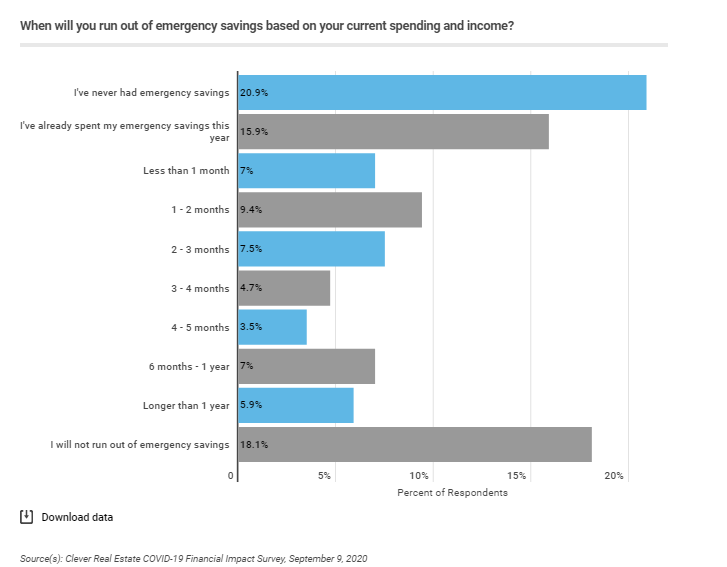

- Lack of Emergency Savings: The Federal Reserve4 suggests that two out of five Americans do not have enough money in savings to cover a $400 emergency, and now, since the start of the pandemic, one study5 found that 61 percent of Americans have no emergency savings at the start of 2021.

- Use of Payday Loans: Payday loans have an average annual percentage rate of nearly 400 percent, and if a borrower can’t pay off the loan quickly, they run the risk of getting deeper and deeper into debt as the interest rate rises to over 500 percent6. Unfortunately, 12 million Americans7 use payday loans each year.

- Inability to Retire on Time: A Yahoo Finance study found that 45 percent of Americans have no money in their retirement account. Nineteen percent of Americans have less than $10,000, and another 20 percent have between $10,000 and $100,000. This means that 84 percent of Americans will reach retirement age without the funds to support themselves.

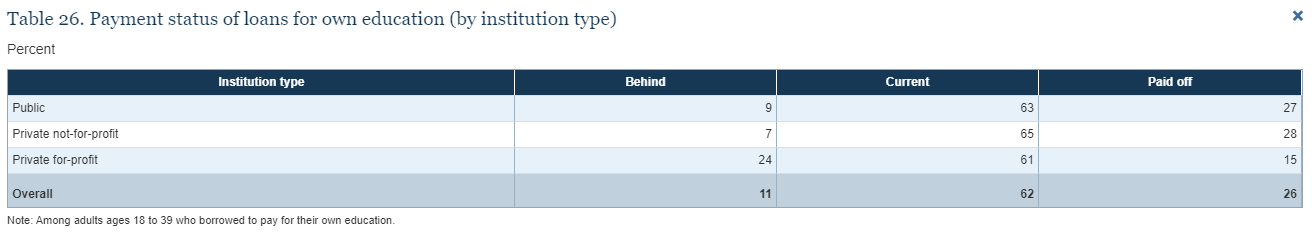

- Student Loan Debt: The Federal Reserve reports8 that 44.7 million Americans hold $1.71 trillion in student loan debt. Before the pandemic when defaults on student loans were halted, 11.1 percent of student loans were delinquent or in default.

Financial wellness programs help individuals understand the financial concepts behind the financial difficulties they are facing and go further to provide skills and action steps that can reduce the hardships.

Financial wellness puts financial literacy into action in the lives of your employees.

Who Needs Financial Wellness?

There is a misconception that financial stress happens primarily to those who do not make a lot of money, such as entry-level workers, or among younger employees who haven’t had the time or experience to understand their finances.

The truth is that financial stress crosses all demographics whether that be age, income, sex or race.

One recent study? showed that although entry-level workers were the most financially stressed group, second place went to presidents and vice presidents of companies followed closely by C-suite executives.

The PWC survey looked at life stages and found that each stage of life contained financial stressors regardless of income level:

- Those nearing retirement may be caring for an aging parent or trying to help a child through college while still putting money away in their 401(k).

- Entry-level employees are often strapped with student loans and may have difficulty creating a budget that will simultaneously allow them to pay off their debts, get an early start on retirement savings, and save for a down payment on a house.

- Employees of all ages deal with life events such as marriage, divorce, or the birth of a child as well as financial issues such as getting spending under control, paying off debt, saving for major purchases, figuring out the best investments, and managing healthcare expenses.

Who needs financial wellness? Everyone – and those surveyed in the Consumer Finance Literacy Survey¹° agree.

Regardless of their score on the financial literacy test, three out of four individuals believe they could benefit by acquiring the right financial information, skills, and attitudes.

Where To Get a Financial Wellness Program

There are many different financial wellness providers, each having its own strengths and weaknesses.

Here are the major providers of employee financial wellness programs:

| Pros | Cons | |

| Banks | A majority of Americans have some sort of relationship with a bank allowing financial wellness to reach a large number of people | These programs have the potential to be biased toward and promote bank products and services |

| Credit Unions | Nonprofit entity concerned about their members | Often offer programs without the latest in technological advancements |

| Record Keepers and Financial Advisors | Financial planning is their occupation, so it is a natural fit | Potential for biased information or a conflict of interest promoting specific products. Likelihood to focus too much on retirement plan participation |

| Financial Wellness Companies | Ability to offer unbiased information in a holistic manner | Depending on the delivery system, may be costly |

How and When Is Financial Wellness Delivered to Employees?

There are many different methods for delivering financial wellness information, tools, and action steps – each with its own pros and cons.

| Pros | Cons | |

| Digital Tools | Private; lower cost due to economies of scale; can be individualized | Without the right communication, employees may not be aware of the program; some employees may feel uncomfortable using technology |

| One-on-One (includes live chat and telephone) | Private; offers individualized information | High cost |

| On-site Workshops | Low cost; easy to advertise; offers information to a large group at once | Lack of privacy; information is less individualized |

| Online Webinars | Low cost; easy to advertise; offers information to a large group at once | Lack of privacy; information is less individualized; employees may feel uncomfortable with the technology |

The PWC survey found that employees tend to use financial wellness programs when they need specific information.

When employees were asked when they seek financial guidance, they gave the following answers:

- 35 percent When making an important financial decision

- 26 percent When in the midst of a financial crisis

- 10 percent When experiencing a life event

- 8 percent Never

- 3 percent On an ongoing basis

- The remaining 18 percent gave other reasons for seeking financial help

That’s why financial wellness programs should offer both ongoing, proactive education to help individuals avoid financial problems and stay on track, as well as just-in-time education to offer solutions to current problems.

What to Expect from a Financial Wellness Program

Not all financial wellness programs are created equal.

However, the best programs offer a wide variety of courses, tools, and assessments to help employees on their path toward financial wellness.

At Enrich, we offer such things as:

- Interactive courses on topics such as budgeting, retirement planning, investing, and identity theft

- Interactive tools such as a retirement analyzer, home affordability tools, and budgeting tools

- Interactive assessments such as the financial wellness checkup, financial stress assessment, and an engaging financial behavior assessment.

Financial Wellness Engagement and Utilization

Engagement with your financial wellness program will help your company understand how employees use and engage with the program, how often they do so, what classes they take, and other information to help you understand how valuable your employees find the program you’ve chosen.

Having this information will help you fine-tune the program to meet the needs of your specific employees.

Be sure to choose a program that offers these statistics regularly.

Utilization, on the other hand, speaks directly to the percentage of employees that use the program.

Finding an average is difficult because it depends on many things, such as:

- The goals of the program: Some program goals address the general population of employees (such as reducing financial stress) while others address a more limited population (such as reducing high debt or starting an emergency savings account). This will affect the utilization rate.

- Company commitment: Companies that offer the benefit but put few resources into the program will see about 5 percent utilization, while companies that create goals, measure metrics, communicate to employees, optimize their website, and offer incentives are more likely to get upwards of 70-percent utilization.

- Offering Incentives: Incentives can increase utilization by as much as seven times for an incentive offered to every employee and two times for sweepstakes-style incentives.

- Program communication: Creating emails with a high open-rate, tying communication to existing employee communications, and optimizing your website to promote financial wellness all lead to higher utilization rates.

For a deeper dive on this topic, check out “What is a Good Engagement Level for a Financial Wellness Program?”.

Financial Wellness ROI

The most fortunate part of offering a financial wellness program to your employees is that helping them become financially well is also good for the company—the return on investment for such programs is substantial.

When employees participate in financial wellness, companies experience greater productivity, higher 401(k) participation and more on-time retirement while reducing absenteeism, employee turnover and healthcare costs.

Traditional financial wellness plans have an ROI of 300 percent. However, digital solutions like Enrich have an ROI of 1500 percent or more.

1 - https://gflec.org/initiatives/sp-global-finlit-survey/

2 - https://www.capitalone.com/about/newsroom/mind-over-money-survey/

3 - https://www.pwc.com/us/en/industries/private-company-services/ima

4 - https://www.federalreserve.gov/publications/2019-economic-well-being-of-us-households-in-2018-dealing-with-unexpected-expenses.htm

5 - https://listwithclever.com/research/covid-impact-september/

6 - https://www.incharge.org/debt-relief/how-payday-loans-work/

7 - https://www.consumerfinance.gov/payday-rule/

8 - https://www.federalreserve.gov/publications/2020-economic-well-being-of-us-households-in-2019-student-loans-other-education-debt.htm

9 - https://www.businesswire.com/news/home/20200212005534/en/Salary-Finance-Study-Finds-More-Than-40-percent-of-American-Workers-Are-Feeling-Significant-Fina

10 - https://cdn2.hubspot.net/hubfs/5146491/NFCC_2019%20FLS_datasheet%20with%20key%20findings_032519.pdf

Featured Posts

Employers and Organizations

3 MIN

10 Simple Ways Benefits Managers Can Recession-Proof Their Employee Benefits Package

Employers and Organizations

3 MIN

3 Reasons to Make After-Tax Contributions to Your Retirement Plan

Employers and Organizations

4 MIN

Financial Information vs Employee Behavior Change: Which Is More Important for Your Company’s Financial Wellness Program?

Employers and Organizations

3 MIN

Does Your Employee Financial Wellness Program Take Mindset Into Consideration?

Related Posts

Enrich News

2 MIN

How Do We Define Financial Wellness?

Employers and Organizations

4 MIN

The Difference Between Good Financial Wellness Programs and Great Financial Wellness Programs

Employers and Organizations

4 MIN

How to Create an Employee Financial Wellness Survey